Market Update - 3/30

Market Update

As we head into the second week of quarantine..

We're answering your most common market questions!

After our first full week of being home with the kids and mostly telecommuting, I’ve had a chance to reflect on the rapidly changing environment that we are in and wanted to share some of my thoughts.

To begin with, the idea of telecommuting is nothing new and I think it’s going to help us weather this unprecedented storm. The issue is obviously going to be for the workers who can’t do their jobs remotely, the small businesses who lose so much business that they can’t pay their workers to continue to come to work, and the industries that are being hit hardest including hospitality, oil and gas, and the financial sector. In Arizona, we have intentionally diversified from the heavily construction based economy that we had in the early 2000s, to one with a strong IT, healthcare, and manufacturing portfolio that continues to drive growth in the area and relocation to the area. I think we’ll see the value of diversification in the coming months.

Last week was nothing short of amazing to see how the community has banded together to support each other with an immediate shift to supporting local businesses, getting the word out there through social media and local news outlets about the food banks and the blood banks in need and where volunteers can assist, and the organic partnerships that have been created as individuals and businesses share what they have and what they need creating a bartering system that fuels community connectedness and resource sharing. It is so motivating to wake up each day and see a new thread on social media about someone giving their extra roll of paper towels to a neighbor in need or a news story about the local breakfast spot serving free breakfast on the weekends. Giving back is just what we do here.

I think that we’ll also find that Arizona is going to be one of the best positioned states to enter this stage of uncertainty and to come out on top. Without minimizing the amount of financial strain and stress the stock market loss has caused and the expected job loss in certain industries will cause - there will be opportunity not as a result of the hardship but in spite of it. When COVID-19 came to the Valley, we were and still are in one of the strongest seller’s markets the Valley has ever seen. With inventory less than 50% of what it was last year in many areas and interest rates at historic lows the opportunity for buyers to buy into an appreciating market and sellers to leverage the equity in their home was unprecedented. At that rate we were going, it was expected that buyers would have to continue to compete with dozens of offers to get into their home and sellers were going to have to get good about moving quickly because the time on market was dwindling rapidly.

At the beginning of last week, we started to see a fluctuation in the interest rates that scared consumers. It's hard to keep interest rate fluctuation in perspective when its tied to a global pandemic but whether your interest rate starts with a 3 or a 4, you are doing pretty good. The problem really was for those buyers who were looking at the top of their price range or who were prequalified during the first week of March when interest rates dipped and then their monthly payment was suddenly significantly higher. Our team is checking the numbers with the lender before every offer that we put in and making sure we’re having conversations about the range in monthly payments you can expect based on the daily fluctuation and making sure that we’re looking in a price range where that range is comfortable for you.

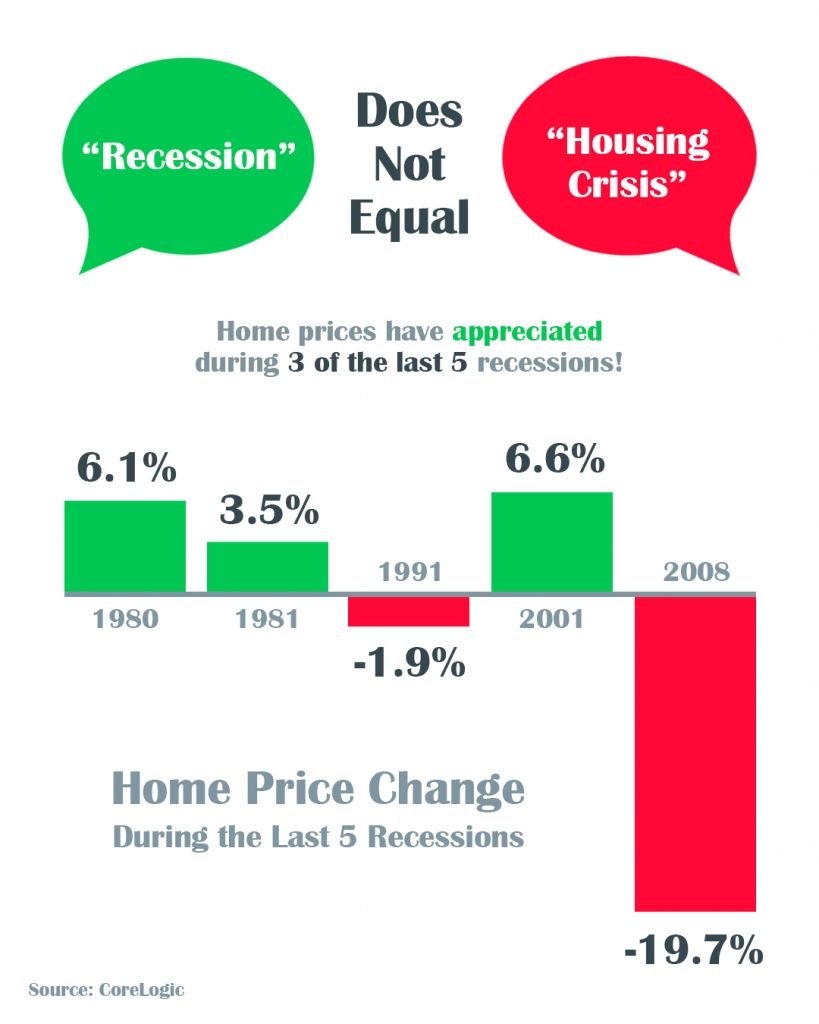

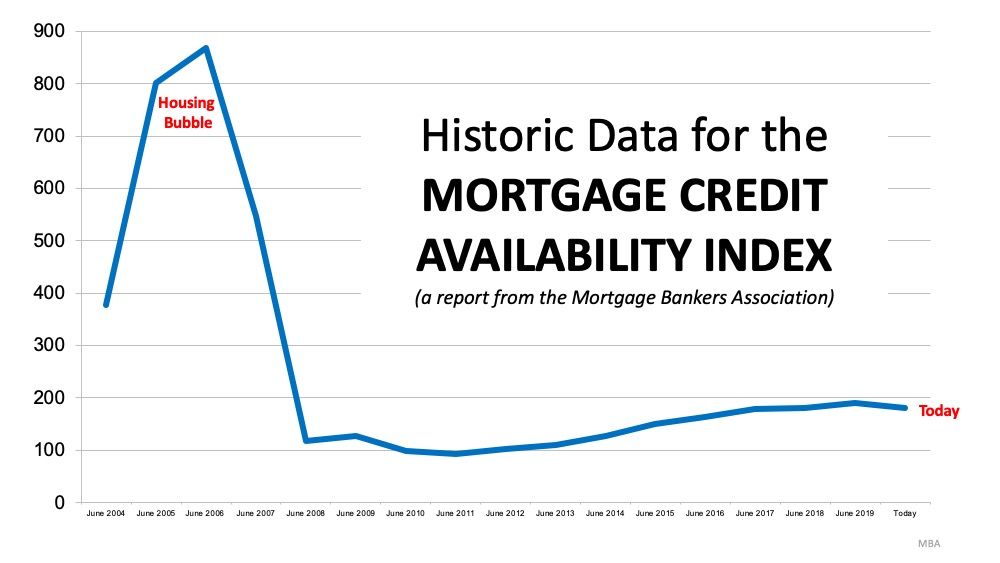

Towards the middle of last week, we started to field a lot of questions about a recession and what that could mean for the local housing market. While interest rates dominated the minds of consumers with the fall of the stock market at the beginning of the week, the middle of the week brought extended school closures, sheltering in place, and take-out only options from restaurants which started to immediately impact the wages of some and the life savings of others. It also begged the question of how we would fare differently during this stock market crash than we did in the early 2000s - a question answered only by how different the circumstances are this time. In 2005, the housing market started to fall because the demand was mostly false and so when demand literally fell off a cliff in 2006, so did the marketability and value of homes. The demand now is only 4% above average but the driver of the housing prices is not demand, it is supply. Builders have been playing catch up for the last 2 years after 10 years of under building - and will likely not be able to build as much as they had hoped this year due to a shortage of material and labor, a factor that certainly won’t aid in a flood of supply. The hardship will likely cause some renters to not be able to pay rent, evictions to follow and maybe some sales of rentals as landlords need to liquidate cash - that would be a welcome addition of supply to an extremely under supplied market. Same with homeowners who need to leverage the equity in their home to downsize or to make payments - housing is still a basic necessity and a sale will still create the need for another house if the owner occupant stays local.

As we closed out the week, we started seeing some of these midweek predictions come to light as we are already seeing a higher number of listings come on to the market - with 2750 new listings in the last 7 days up 10% from this same week last year. With the recent announcement by some of the top iBuyers including Opendoor cancelling escrows leaving clients who previously relied on their “easy” and “sure” way of selling high and dry and AirBnBs being put on the market due to a lack of bookings adding some much needed entry level inventory to the market, I’d expect to be busy this week helping clients navigate the moving and selling process in these cautious times.

We’re taking extra precautions when showing property, have virtual solutions for getting our seller’s priced and marketed, and will continue to provide information through our social media challenges as we have it from local, reputable, trusted sources who understand our local market. Whether its an extra can of soup, picking up donations for a local shelter, or posting your restaurants curbside menu, we are in this together and for the long haul.

Covid19 Resources

5 Simple Graphs Proving This Is NOT Like the Last Time

With all of the volatility in the stock market and uncertainty about the Coronavirus (COVI...

Coronavirus Disease 2019 (COVID-19)

Coronavirus disease 2019 (COVID-19) is a virus (more specifically, a coronavirus) identifi...

Coronavirus Tax Relief | Internal Revenue Service

To explain the tax relief for those affected by coronavirus...

.png)

.png)

.png)

.png)