What's Up Southeast Valley? August 2020

Back to School

Welcome back to our What's Up Southeast Valley for the month of August!

Since our last broadcast, there have been many changes within our community, environment, work life, home life and how we conduct our days, including kids going back to school in an online work environment.

We are in this together and will get through this together!

How We Conduct Our Days

We continue to face our daily challenges and uncertain times together. Many of you had kiddos that went back to school this month. Now, we're juggling homeschool and working from home. In spite of the challenges our community is facing, we have remained diligent in supporting our community through highlighting local businesses, giving back through food, water & clothing drives, helping families continue to move forward through weekly COVID-19 challenges and changes, pivoting our business model to meet the needs of our clients & business partners, offering more virtual services, growing our team, finding new ways to thank our current and past clients, reaching as many of you as possible and spreading the word that we are here for you no matter what!

👀 Watch Our LIVE!

We Are Hiring

The Amy Jones Group is growing! We are hiring for a Client Care Coordinator and Real Estate Sales Professionals. With more than 150 families served in 2019 alone, we are looking for EXPERIENCED agents to join our Southeast Valley team. Known for our excellent client care, exceptional negotiation skills, world class digital marketing, and being trusted advisors in the SE Valley for more than a decade - we are looking for hard working, ethical, creative, real estate professionals who love to learn and thrive in a team environment, where giving back and giving to each other is important to our overall success. For more information on who we are and how to apply, visit https://www.amyjonesgroup.com or send your resume to [email protected]!

Ask About Our Summer Listing Special

📈 Market Update

💬 Covid-19 Market Response

Here are the basics - the ARMLS numbers for August 1, 2020 compared with August 1, 2019 for all areas & types:

- Active Listings (excluding UCB & CCBS): 8,477 versus 13,746 last year - down 38.3% - and down 3.5% from 8,788 last month

- Active Listings (including UCB & CCBS): 13,259 versus 17,920 last year - down 26.0% - and down 7.1% compared with 14,279 last month

- Pending Listings: 7,550 versus 6,479 last year - up 16.5% - but down 5.5% from 7,993 last month

- Under Contract Listings (including Pending, CCBS & UCB): 12,332 versus 10,653 last year - up 15.8% - but down 8.1% from 13,424 last month

- Monthly Sales: 10,536 versus 9,340 last year - up 12.8% - and up 8.5% from 9,714 last month

- Monthly Average Sales Price per Sq. Ft.: $191.02 versus $169.72 last year - up 12.6% - and up 4.5% from $179.82 last month

- Monthly Median Sales Price: $315,000 versus $280,000 last year - up 12.5% - and up 3.3% from $305,000 last month

The housing market is extremely strong and has been hitting a number of new records in the last few days. See the Daily Observations for more details on these.

We can see that supply remains very low indeed, but has only declined 3.5% over the past month, a much weaker trend than last month. This is because we are seeing far more new listings than we got during the first half of the year. This increase in new listings appears to be setting in for the long run, which is a little bit of good news for buyers.

July 2020 was a very active month for closings, up almost 13% compared with July 2019. All those closings have caused the number of listings under contract to decline 8% since last month, but the total remains very high for early August and it is up nearly 16% compared with August 2019. We can conclude that demand has not only recovered from the COVID-19 pandemic, but has reached heights that make it very strong by any historical standard.

We should all know that when supply is low and demand is high, prices will rise. They certainly did that with a vengeance during July. The monthly average price per sq. ft. rose 4.5% during just 31 days, something we would think quite normal if it were an annual increase. This happened during a summer month, making it even more remarkable, because summer months are usually rather weak for pricing, even in strong markets.

Despite the rise in new listings, the environment is extremely unfavorable for buyers. Not only do they have to contend with prices rising at an unusually high rate, when they do find a house on which they would like to make an offer, they will probably find dozens of other buyers with exactly the same idea in mind.

Sellers are seeing some of the best pricing and terms for their homes in Arizona history and buyers are interviewing real estate agents who are going to be skilled enough to help them win the deal. The challenges for both buyers and sellers in this market extend to the iBuyers (online teams of investors who look to make cash offers on your home often well under market value) who have seen their acquisition numbers collapse since the first quarter and their market share drop substantially as a result. Curious about what working with Opendoor, Offerpad, or Zillow Offers looks like?

What You Need to Know About Those Online Home Value Estimates

Opendoor, Zillow and Redfin have made it easy to give an idea of your home's value but an ...

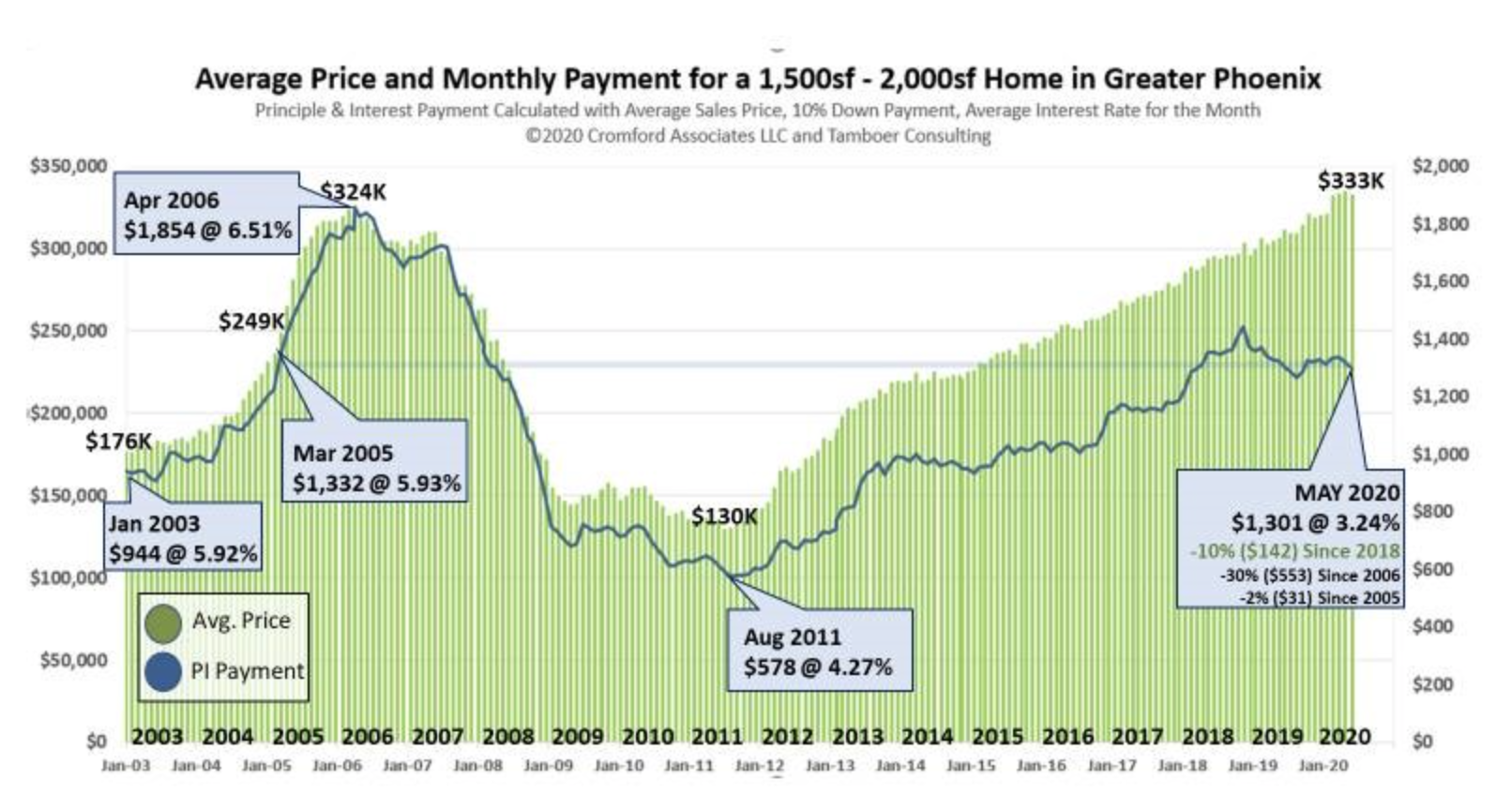

Slow and steady might win the race but it also is the way we’d prefer to describe a market correction when it happens. The current real estate market is pushing the boundaries of unprecedented just like its COVID counterpart who brought along one of the strongest markets in Arizona’s history at a time when many thought that it would simply cease to exist. The extreme shortage of available housing coupled with the booming number of buyers who are taking advantage of historically low interest rates has forced a competitive market unlike anything we’ve ever seen. Sellers are selling for well above asking, buyers are refinancing on houses they’ve lived in for less than a year and everyone is wondering just how long this can possibly go on for. That my friends, is the million dollar question. And when, because it is when and not if, the market is no longer sizzling hot like it is today - will we be talking about the steadying of the market from increased inventory and decreased buyer demand that happened over several years as builders picked up their production and interest rates slowly rose or will we be wondering how we went from frenzy to fizzle so quickly. My gut is that the tortoise will beat out the hare every time but I’d rather be in the race than on the sidelines in the meantime.

Knowing your options is my number one piece of advice for everyone out there with a home, paying for someone else’s home, working from home, homeschooling from home, or wanting to get a home to keep everyone at home in. Gone are the days, at least for now, where you can walk into a builder’s fancy show room and put some money down for the floor plan and lot of your dreams. Want to go see a property that popped up in your neighborhood in three days, after your big meeting on Wednesday, and then sleep on it until Saturday after the kid’s soccer game? Good luck. Buyers have to be prepared, think on their toes, and often make big decisions in little timeframes that can be scary. So why do it? With few homes available for sale in the East Valley, and builders starting lotteries, drawings, and wait lists so that they can time their builds and not take the two years to build your house that their contracts allow (yes, we read the entire contract and yes, they actually have two years to build your home) buyers are uniquely positioned to make one of the most valuable purchases of their lifetime.

Buying A Home In The Gilbert, Chandler, and Mesa Real Estate Market Copy

Buying a home in Gilbert, Chandler, or Mesa can be challenging. Find out how The Amy Jones...

So, if it's such a great time, then why aren’t more people doing it? Why aren’t more homes on the market if it's really a once in a lifetime chance to access that virtual bank account of equity most people are sitting on? It’s typically one of two things - either they are trying to time the market, to ride the coattails of the exceptional market and not pull the trigger until we’ve reached the absolute peak which they’ll only know because we’ve started to come back down, or they are afraid - afraid of how it will all work, afraid of the complications of buying and selling at the same time, afraid of finding something they love as much as their current home, afraid of losing all that equity because it just feels better knowing its there for access when you need it. But the truth of the matter is, it’s not accessible whenever you need it - its accessible now. We’ve already seen the loss of some down payment assistance programs and jumbo loan programs due to COVID, now we’re seeing the loss of some home equity lines of credit programs, greater restrictions for self employed borrowers trying to get cash out from a refinance, and mortgage brokers prioritizing purchase contracts over refinances making it more difficult and taking longer to get that refinance completed.

Schedule An Appointment | Amy Jones Group Copy

In a digital world, it’s nice to connect in person. Schedule a time to talk with the...

So where are we headed? Well, I think we’ll see more people taking out a home equity line of credit in preparation for wanting to purchase without a contingency, I think we’ll see some people leveraging their assets like 401Ks and the like to take out nearly free money to help bridge the gap between their purchase and their sale, and I think we’ll see people using the recast option and graciously accepting gift funds for downpayment and then paying back their family in dollars (and hugs) when their house sells. I also think we’re going to see some buyers move to the sidelines and not because the opportunity doesn’t exist but because they are tired. Tired of fighting tooth and nail for every last bit in the contract, standing in a very real line in the 110+ degree weather waiting for a builder to call their name, and waiting up until 9:30 at night for a seller to agree to change the contract price when the appraisal comes in low. These are all true stories and while we’ve seen and heard many of them in the last 6 months - I think we’ve only started writing the first chapter.

Unprecedented times can be scary but they can also be unique, challenging, exciting, and full of opportunity. Now is not the time to sit in your basement concocting some master plan to play chess with your life’s pieces and only seek guidance when things don’t go as planned. Play the proverbial chairman or woman and assemble your board of experts - lenders, financial advisors, real estate agents, and that one really nice guy at the coffee shop - and let them help you understand your options and how to maximize these unprecedented times.

🙌 Community Spotlight 🙌

The Masked Portrait Project

"Spread Kindness, not germs"

EMILY VANCE

With the current state of the world I have been really struggling to figure out a way to give back to my community. I have always tried to use my work as a way to help others, and lately, that just hasn't been happening. Finally, the idea came to me. I am a major supporter of wearing masks to protect others and I believe that doing so, even when it is hot and uncomfortable, is a way to show kindness, compassion, and love. By creating The Masked Portrait Project, my hope was to show that wearing a mask doesn't have to be sad or depressing. In fact, it really can be the opposite. Wearing a mask is one of the easiest ways to spread kindness and that is something that should be highlighted and celebrated.

Email -

Instagram -

@themaskedportraitproject

Facebook -

https://www.facebook.com/pg/themaskedportraitproject

Website -

Live.Love.Local - Connecting The Southeast Valley

In the last month, we were able to connect with 5 local businesses and share their story with you through our social media website. Connecting with the community lights up our souls and we couldn't be more thrilled to get to know those who run our small businesses. It's so important that we support local, especially right now. Each business below is open, taking appointments, reserving parties and staying safe by following our state guidelines. Let's all do our part in keeping the economy alive, so that when it comes time to fully get back to life, we can all thrive once more.

Amy Jones Group Events

Summer Listing Special

List with us this summer and receive one of the following:

Free Staging Consultation & Decor Package

Free landscaping Service While You are Listed

Free pre-listing and pre-closing cleaning!

Know someone who is looking to buy a home, sell a home or has questions? Send them our way!

*Offer valid until 9/30/2020. A possible savings of up to $1,200 for pre-list staging, up to $600 for landscaping while you are listed and up to $800 for pre-list and pre-close cleaning.

What To Do When You Sell Wednesday's

We have a new series LIVE on Facebook that started THIS WEEK! We want to provide all of the resources to you as possible during these uncertain times and strong real estate market. Low inventory provides a challenge to those who are looking to take advantage of receiving top dollar for their homes, releasing their equity or refinancing. Yes, it's a GREAT time to sell your home. But, then what? What are your options to find a home when inventory is low or the wait lists are long at new home build sites? We are here to help.

This week's topic was Home Selling Solutions for 2020. The Amy Jones Real Estate Group kicked it off with Dan White Loans - Fairway Mortgage where we talked about creative solutions for releasing the equity in your home! Watch the recording below for tips and reach out to us with any questions on what to do when you sell your home.

Market of The Moment

Every week, our preferred vendor, Don Czajkowski with Fidelity National Title has a meeting of the minds to talk about the ever changing real estate market, especially right now. This week, Mindy was a featured guest talking about inventory, new home builds, interest rates, tips to release the equity in your home, alternatives and options to give yourself more time to find a property to purchase when selling and what the Amy Jones Group has been up to this month. Check it out below!

Monthly Blog Review

How Is Remote Work Changing Homebuyer Needs?

How Is Remote Work Changing Homebuyer Needs?...

Not a first time home seller but still have questions about selling your home? Afraid of what happens if you sell and don’t have somewhere to go?

Not sure how refinances, home equity lines of credit, or renovation loans work?

Check out this video series for YOU below!

🙌 Hot on The Market 🙌

UNDER CONTRACT - 13429 N. 151st Dr, Surprise, AZ 85379

13429 N. 151st Dr, Surprise, AZ 85379 - Marley Park | Listed by the Amy Jones Group with K...

UNDER CONTRACT - 2349 E Kaibab Place, Chandler, AZ 85249 - Fonte Al Sole | Amy Jones Group

2349 E Kaibab Place, Chandler, AZ 85249 - Fonte Al Sole | Listed by the Amy Jones Group wi...

UNDER CONTRACT - 401 S Karen Drive, Chandler, AZ 85224 - Fairfax Park | Amy Jones Group

401 S Karen Drive, Chandler, AZ 85224 - Fairfax Park | Listed by the Amy Jones Group with ...

UNDER CONTRACT - 3907 E Carob Drive, GIlbert, AZ 85298 - Bridges East | Amy Jones Group

3907 E Carob Drive, GIlbert, AZ 85298 - Bridges East | Listed by the Amy Jones Group with ...

In Case You Missed It...

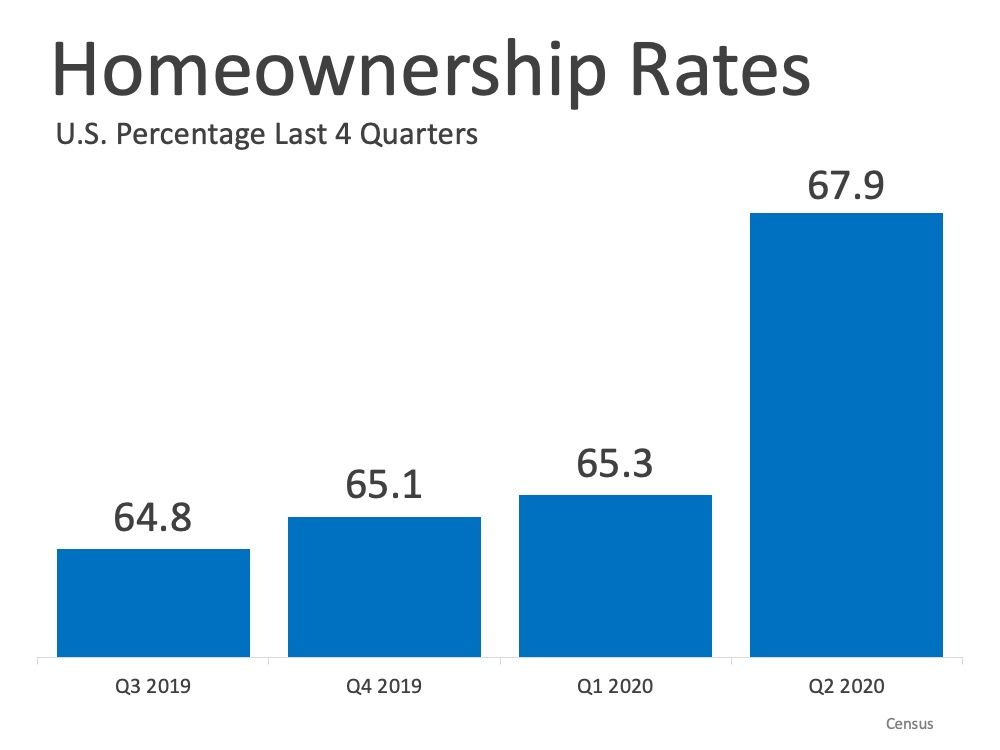

Homeownership Rate Continues to Rise in 2020

Amidst the many roadblocks, the U.S. homeownership rate rose again, signaling great streng...

Three Ways Mortgage Rates Impact Your Home Value

From travel to toilet paper stock at your local grocery store. However, there’s another effect you might want to keep an eye on if you’re a homeowner: Falling mortgage rates. In the United States, the Federal Reserve cut rates by...

Here's What Every Seller Needs to Know About Virtual Showings

The COVID-19 pandemic has brought social distancing rules that have changed everything from your shopping habits to your work schedule to your social life. But if you’re in the middle of selling your home...

Four Ways We're Helping Sellers During These Times

With all of the social media posts and news articles about communities in need, we are committed to serving our friends, clients and neighbors in these uncertain times. We have uncovered countless community organizations...

👏 Congratulations! Mazel Tov! ¡Felicidades!

None of this is possible without our amazing clients.

We'd love to help you or someone you love if we haven't already - or help you again!

Here are the buyers and sellers who made big moves last month...

.png)

.png)

.png)

.png)

.png?w=400)

.jpg?w=400)

.png)